What is payroll in 2025?

Payroll isn’t just about paychecks anymore. In 2025, it’s a tech-powered engine that drives compliance, employee satisfaction, and strategic decision-making. Whether you’re paying a local team or managing a global workforce, modern payroll systems offer real-time visibility, AI-enhanced accuracy, and unmatched flexibility.

Payroll refers to the total compensation a business must pay to its employees for a set period or on a given date. However, in today's digital landscape, payroll encompasses much more than just processing paychecks. It now integrates seamlessly with other business systems, leverages advanced technologies for error prevention and fraud detection, and plays a crucial role in supporting flexible work arrangements and global workforce management.

The evolution of payroll from a purely administrative function to a strategic business asset has been driven by several factors:

Digital transformation: accelerating the adoption of cloud-based, AI-powered payroll solutions

Changing workforce dynamics: including remote work, global mobility, and flexible employment models

Increasing regulatory complexity: requiring sophisticated compliance management

Growing focus on employee experience: demanding more transparent, accessible payroll processes

For businesses in 2025, effective payroll management is no longer optional—it's a competitive necessity that impacts everything from regulatory compliance and financial planning to employee satisfaction and reten

What are the Advantages of Modern Payroll Systems?

1. Accuracy Through Payroll Automation Software

Manual payroll is error-prone. A modern payroll management system uses automation and AI to handle complex calculations—taxes, deductions, benefits—with unmatched precision. It even flags anomalies before they become costly mistakes.

2. Real-Time Insights That Drive Decisions

Smart payroll automation software offers real-time dashboards and customizable reports. Track labor costs, identify trends, and use predictive analytics to forecast payroll expenses—boosting your financial planning and workforce strategy.

3. Hassle-Free Compliance

Modern payroll systems are essential for businesses to stay compliant with ever-changing labor regulations. These systems automatically update to reflect the latest legal requirements, reducing the need for manual adjustments. Features like built-in audit trails and tax-ready reports streamline administrative tasks, minimizing both workload and compliance risks. By adopting such advanced payroll solutions, companies can focus more on growth and less on navigating complex regulatory landscape and Tracking key payroll metrics helps companies ensure accuracy, compliance, and cost control.

4. A Better Employee Experience

Today’s employees expect more. Self-service portals let them access pay stubs, update details, and manage direct deposits anytime. Some systems also offer earned wage access, giving staff early access to their earnings—enhancing financial well-being. With employee self-service, staff can access payslips, tax forms, and salary details with ease.

5. Built for Flexibility and Global Teams

Whether your team is remote, hybrid, or global, multi-country payroll capabilities ensure accurate payments and compliance. These platforms support multiple employment types—from full-time to gig workers—across borders and tax jurisdictions.

6. Security That Goes Beyond the Basics

With payroll data being a top target, modern systems use encryption, MFA, and blockchain for secure, tamper-proof transactions. AI also helps spot fraudulent patterns, protecting your business and your people.

What are the components of payroll?

Payroll components can be broken down into several key elements, each crucial for calculating what an employee is paid by their employer. Here's a simplified overview:

1. Employee Information & Company Pay Policy

Accurate employee information remains the foundation of effective payroll processing. Modern systems maintain comprehensive digital profiles for each employee, including personal details, tax information, employment status, and job classification. These profiles are securely stored and easily updatable through self-service portals.

Company pay policies have become more sophisticated to accommodate diverse workforce needs. These policies now address not only traditional elements like pay schedules and overtime rules but also modern considerations such as:

- Remote work compensation adjustments

- Global pay equity frameworks

- Flexible work arrangement policies

- Performance-based compensation models

- Recognition and spot bonus programs

The integration of these policies into digital payroll systems ensures consistent application across the organization while providing the flexibility to adapt to changing business needs and employee expectations.

2. Salary, Allowances & Digital Compensation

The basic salary continues to form the core of employee compensation, but today's payroll systems handle a much wider range of payment types:

Base salary/wages: The fixed amount an employee earns before any additions or deductions

Digital payment methods: Beyond traditional direct deposit, systems now support digital wallets, cryptocurrency options (where legally permitted), and instant payment capabilities

Allowances: Specialized payments for housing, transportation, remote work expenses, and other job-related costs

Flexible compensation models: Including pay-for-performance, skill-based compensation, and value-based payment structures

Modern payroll systems can also manage complex compensation scenarios like split payments (dividing pay between different accounts or currencies) and location-based compensation adjustments for distributed teams.

3. Gross vs. Net Salary & On-Demand Pay

The distinction between gross salary (total earnings before deductions) and net salary (take-home pay after deductions) remains important, but modern payroll systems provide greater transparency into this calculation. Interactive pay statements allow employees to see exactly how their gross pay is calculated and what deductions are applied, improving understanding and reducing payroll inquiries.

A significant innovation in this area is on-demand pay (also called earned wage access), which allows employees to access a portion of their earned but unpaid wages before the regular payday. This feature helps employees manage cash flow emergencies without resorting to high-interest loans or credit card debt, supporting overall financial wellness while maintaining proper tax and deduction calculations.

4. Tax Deductions, Compliance & Global Considerations

Tax management has become increasingly complex with remote and distributed workforces. Modern payroll systems automatically calculate and withhold:

- Federal, state, and local income taxes

- Social Security and Medicare contributions (with the updated 2025 wage bases and rates)

- Retirement plan contributions with the latest 401(k) limits

- Health insurance and other benefit deductions

- Garnishments and court-ordered withholdings

For multinational organizations or those with remote international employees, payroll systems now incorporate global tax engines that ensure compliance with various country-specific tax regulations, treaty provisions, and reporting requirements. These systems can handle multiple currencies, international banking requirements, and country-specific data privacy regulations.

5. Blockchain and Security Infrastructure

A newer but increasingly critical component of modern payroll is the security infrastructure that protects sensitive employee and financial data. Blockchain technology is being adopted to create tamper-proof records of payroll transactions, providing an immutable audit trail that enhances both security and transparency.

Additional security components include:

- End-to-end encryption for all payroll data

- Multi-factor authentication for system access

- Role-based permissions that limit data access based on job requirements

- Automated compliance with data protection regulations like GDPR and CCPA

- Secure API integrations with banking and financial systems

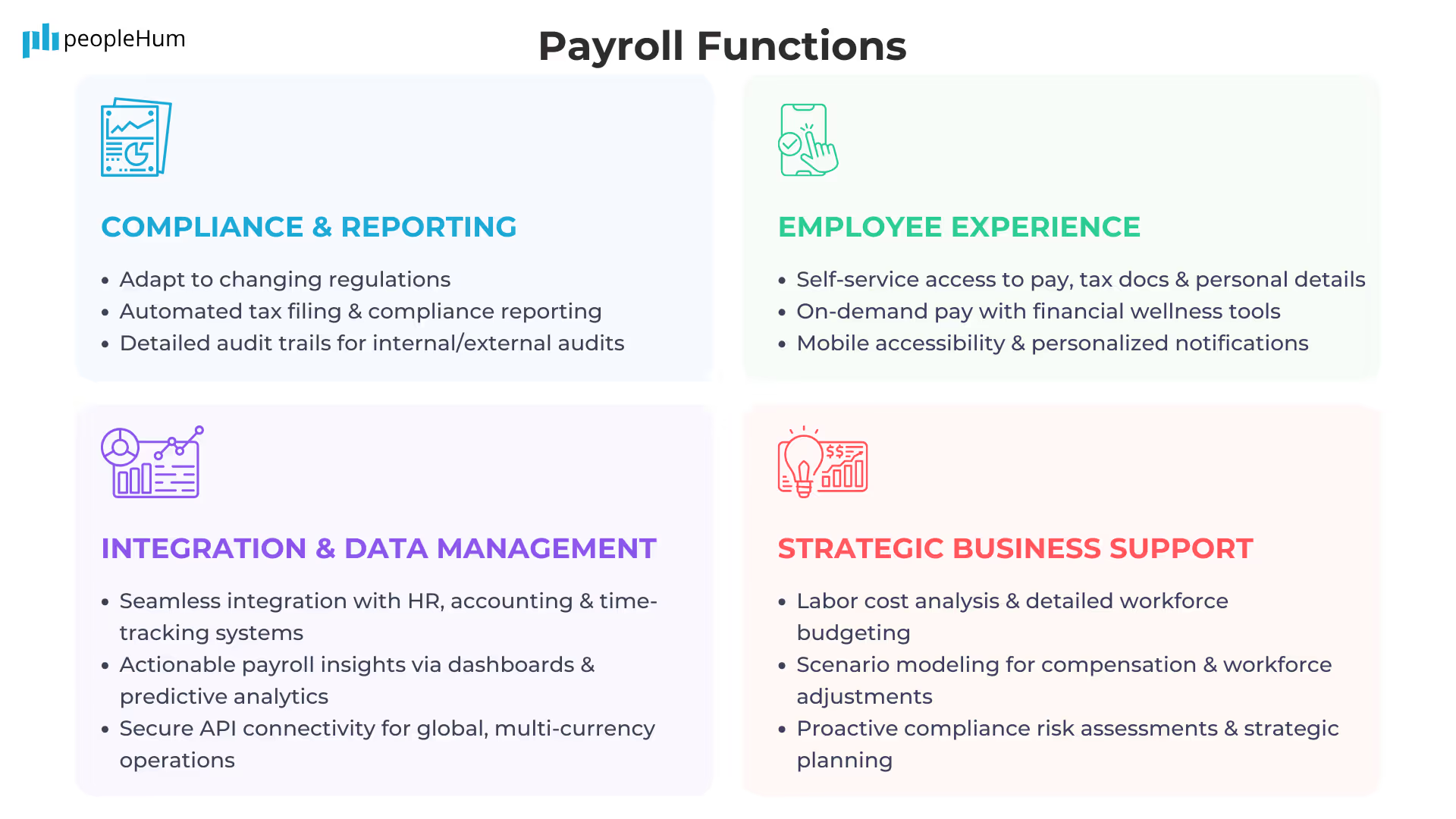

What are the functions of payroll?

A well-organized payroll system not only ensures timely and accurate compensation for employees but also upholds compliance with complex tax laws and labor regulations. This introduction explores the critical functions of payroll, highlighting how it contributes to efficient financial management, boosts employee satisfaction, and ultimately supports the strategic goals of a business.

Compliance and Reporting Functions

Staying compliant in a rapidly changing regulatory landscape is non-negotiable. Modern payroll automation software simplifies this by ensuring all compliance tasks are accurate and up-to-date.

- Regulatory compliance: Automatically adapts to new laws like the 2025 federal overtime threshold of $58,656 and varying state minimum wage rules.

- Tax filing: Prepares and submits necessary forms to federal, state, and local authorities.

- Compliance reporting: Generates mandatory reports for regulatory bodies.

- Audit support: Maintains audit-ready documentation and detailed trails to assist during internal or external reviews.

Integration and Data Management Functions

A well-integrated payroll system enhances data accuracy and operational efficiency by syncing seamlessly with other business platforms.

- System integration: Connects with HR, accounting, time tracking, and more to eliminate duplicate data entry.

- Data analytics: Converts payroll data into actionable insights using dashboards and predictive reports.

- API connectivity: Facilitates secure data exchange with third-party tools and financial institutions.

- Global data management: Supports multi-country payroll operations with multi-currency and multi-jurisdiction capabilities.

Employee Experience Functions

A modern payroll system isn't just for HR—it empowers employees with real-time access and financial tools that elevate the overall experience.

- Self-service access: Employees can securely view pay info, tax documents, and personal records on their own.

- On-demand pay: Offers earned wage access, letting employees access part of their income before payday.

- Financial wellness tools: Includes budgeting assistance, savings features, and educational content.

- Mobile accessibility: Access to payroll info on the go through user-friendly mobile apps.

- Personalized communications: Sends timely, customized notifications about pay cycles, benefits, or upcoming deadlines.

Strategic Business Support Functions

Today’s payroll systems provide insights that support broader organizational planning and workforce optimization.

- Labor cost analysis: Breaks down workforce expenses to aid budgeting and cost control.

- Scenario modeling: Enables "what-if" simulations for compensation adjustments or staffing changes.

- Compliance risk assessment: Flags potential compliance issues before they escalate.

- Workforce planning support: Supplies data to drive better hiring, retention, and workforce management decisions.

What are the challenges in implementing payroll?

- Compliance with complex laws and regulations

- Maintaining confidentiality of payroll information

- Ensuring data backup to prevent loss.

- Managing diverse employee information and timesheets accurately

- Avoiding pay calculation errors

- Integrating various payroll input sources effectively

How is payroll calculated?

To calculate payroll, you can use this formula:

Net pay= Gross salary- Total deductions

Where,

Gross salary= Basic salary + allowances + HRA + DA + bonuses

Total deductions: Provident fund + professional tax + income tax + other deductions (loans, insurance, etc)

What is the difference between salary and payroll?

Salary refers to the amount paid to an employee for their services, usually expressed as an annual figure but paid in regular installments. Payroll, on the other hand, is a broader term that includes the entire process of managing and executing the payment of salaries to employees. This includes calculating salaries, bonuses, deductions, and taxes, as well as the actual distribution of payments. While salary is about the amount, payroll covers the management and execution of paying that amount along with other compensation-related tasks.

Is payroll a part of HR or accounting?

Payroll, a critical aspect of business operations, is typically managed by HR due to its intricate nature. HR oversees these processes to ensure fair compensation for employees' work. By diligently managing payroll, HR departments play a pivotal role in maintaining employee satisfaction and organizational compliance. Essentially, HR serves as the bridge between employees and financial transactions, guaranteeing accurate and timely compensation. This responsibility underscores the importance of HR's role in fostering a positive work environment and upholding ethical business practices within the organization.

What are payroll taxes?

Payroll taxes are the taxes that employers withhold from employees' wages or salaries and remit to the government. These taxes are typically calculated as a percentage of an employee's income and are deducted directly from their paycheck. The purpose of payroll taxes fund various government programs and initiatives. In countries like India, these taxes contribute to social security programs, healthcare schemes, and other welfare initiatives aimed at supporting citizens.

Payroll taxes may include various components, such as:

- Income tax: A tax imposed by the government on an individual's income, which is calculated based on the individual's earnings and tax brackets.

- Social security tax: A tax levied to fund social security programs that provide benefits to retirees, disabled individuals, and survivors of deceased workers.

- Medicare tax: A tax that funds the Medicare program, which provides health insurance to people aged 65 and older, as well as certain younger individuals with disabilities.

- Employer and employee contributions: Payroll taxes often involve contributions from both employers and employees. While some taxes are withheld from employees' wages, employers may also be required to contribute a portion of payroll taxes on behalf of their employees.

- Compliance: Employers are responsible for accurately calculating and withholding the appropriate amount of payroll taxes from employees' paychecks. They must also ensure timely remittance of these taxes to the government authorities as per the applicable laws and regulations.

FAQ's

What is the difference between payroll and HRIS

Payroll refers specifically to the process of calculating employee compensation, tax deductions, and distributing salaries. HRIS (Human Resource Information System), on the other hand, is a broader platform that manages employee data, performance, benefits, and more—including payroll as one of its modules.

How can small businesses benefit from payroll automation?

Payroll automation helps small businesses reduce manual errors, save processing time, comply with tax regulations effortlessly, and improve employee satisfaction by ensuring timely, accurate payments.

What is earned wage access (EWA)?

Earned Wage Access allows employees to access a portion of their already-earned salary before the official payday. It's a popular feature in modern payroll systems, especially helpful for improving employee financial well-being.

How do modern systems handle international payroll compliance?

Modern payroll systems use AI and cloud infrastructure to track country-specific tax laws, labor regulations, and employee classifications—automatically adjusting calculations to remain compliant in each region.

What is the role of HR payroll?

HR payroll manages employee compensation, handles tax deductions, ensures compliance with labor laws, and maintains accurate payroll records.

How can small businesses simplify payroll management?

Small businesses can simplify payroll management by using automated payroll software, outsourcing payroll services, and staying updated with tax laws and regulations.

What are the types of payroll?

The types of payroll include in-house payroll, outsourced payroll, and managed payroll services, each varying in the level of control and involvement from the business.

.avif)