What is a Budget?

Budgeting is a fundamental aspect of financial management that plays a pivotal role in the strategic and operational functions of human resource management. As aspiring HR professionals or fresh entrants in the field, understanding the essence of a budget is vital for fostering efficient resource allocation and strategic decision-making within an organization.

A budget can be defined as a comprehensive financial plan that outlines anticipated income, expenses, and resource allocations within a specified timeframe. In the realm of HR, budgets serve as a structured framework to manage financial resources for HR-related initiatives, encompassing employee salaries, training programs, recruitment costs, benefits, and other essential HR functions.

Recognizing the significance of budgeting within HR operations is crucial. It enables the alignment of HR strategies with the overall organizational goals, ensuring effective utilization of resources, and facilitating informed decision-making. Integrating budgetary considerations into HR functions empowers professionals to optimize talent management, foster employee development and contribute to the company's financial health and success.

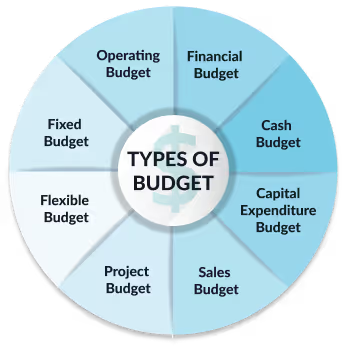

Types of budget

Different budgets serve specific intent. Each budget should be designed to serve the required purpose and goals within personal finance, business or governmental sectors. Some common types of corporate budgets are:

Operating Budget:

The operating budget is the blueprint for managing the daily functions of a business. It encompasses all regular expenses such as sales, production, labor, materials, utilities, and administrative costs. This type of budget is crucial for keeping operations running smoothly and ensuring the company meets its short-term financial obligations. By forecasting income and expenses, it helps businesses avoid overspending and ensures resources are allocated efficiently.

Financial Budget:

A financial budget focuses on the bigger picture of a company’s financial health. It deals with major financial elements like capital expenditures, long-term investments, cash flow, and the preparation of financial statements such as the balance sheet. This budget helps businesses plan for sustainable growth by ensuring that funds are allocated for both short-term needs and long-term goals like expansion or debt repayment.

Cash Budget:

The cash budget zeroes in on the flow of cash in and out of the business over a specific period. It provides a detailed prediction of when money will be received (inflows) and when payments will need to be made (outflows). This budget is essential for maintaining liquidity, preventing cash shortages, and ensuring the business has enough cash on hand to meet its immediate needs, such as paying employees or suppliers.

Capital Expenditure Budget:

This budget is all about planning for significant investments in assets such as property, machinery, or infrastructure. It outlines the estimated costs, timelines, and expected returns of these long-term investments. By using this budget, companies ensure that their investments align with their strategic goals and that funds are available for acquiring or upgrading essential resources.

Sales Budget:

The sales budget is a forecast of the revenue a business expects to generate over a specific period, usually based on market trends, historical data, and sales team projections. It serves as the foundation for other budgets since sales revenue influences production planning, marketing efforts, and resource allocation. A well-prepared sales budget helps businesses set realistic goals and align their operations with expected demand.

Project Budget:

Tailored to specific initiatives, the project budget outlines the costs, resources, and expected outcomes of a particular project. Whether launching a new product, expanding to a new market, or implementing a system upgrade, this budget helps manage the project efficiently. It ensures all necessary resources are in place and provides a clear financial plan to avoid overspending or running out of funds mid-project.

Flexible Budget:

A flexible budget is designed to adapt to changes in business activity, such as varying sales volumes or production levels. Unlike fixed budgets, it adjusts based on real-time data, offering a more accurate view of financial performance. This type of budget is particularly useful in dynamic industries or uncertain market conditions where activity levels can fluctuate significantly.

Fixed Budget:

The fixed budget remains constant regardless of changes in business activity or external conditions. It is typically used when a business has stable operations and predictable expenses. While it is easier to prepare and track, it may not account for unexpected changes, making it less suitable for businesses with fluctuating revenues or costs.

These budgets each serve a distinct purpose, helping businesses manage resources effectively, plan for the future, and achieve their financial goals. By understanding and utilizing the right type of budget, organizations can make informed decisions and drive sustainable growth.

Preparing Corporate Budgets

Corporate budgeting is the backbone of organizational financial planning. It enables businesses to strategically allocate resources, manage costs, and align departmental objectives with overall company goals. For HR leaders and CXOs, understanding the budgeting process is key to informed decision-making and driving sustainable growth.

Key Components of Corporate Budgeting:

1. Strategic Alignment:

Every budget begins with strategy. Budgeting decisions are aligned with the company’s mission, vision, and long-term objectives—ensuring every financial move supports broader business goals.

2. Budget Period:

Budgets are typically created on an annual basis, though quarterly or multi-year plans may apply based on industry dynamics, business goals, or economic shifts.

3. Revenue Forecasting:

Using historical trends, market insights, and sales projections, companies estimate expected revenues. Input from sales, marketing, and operations ensures accuracy.

4. Expense Planning:

Detailed projections of operational expenses—covering salaries, benefits, R&D, marketing, infrastructure, and capital expenditures—form the core of budget planning.

5. Departmental Budgets:

Each department—including HR—prepares its own budget aligned with company priorities. These are consolidated into a master budget, promoting accountability and strategic clarity across units.

6. Capital Budgeting:

This involves long-term investments like technology upgrades, facility expansion, or acquisitions—focused on ROI and strategic growth.

7. Budget Approval:

Budgets are reviewed, negotiated, and approved by senior leadership. The goal is to ensure financial feasibility while supporting the company’s direction.

8. Implementation:

Once approved, the budget becomes the financial roadmap. Departments manage their spending within allocated limits, using the budget to guide day-to-day operations and strategic initiatives.

9. Monitoring and Control:

Regular budget tracking compares actuals against projections. Variances are analyzed, and corrective actions are taken to stay on course. Transparent reporting is essential for informed decision-making.

10. Revisions and Flexibility:

Budgeting isn’t static. Companies revisit and adjust budgets to reflect new priorities, economic conditions, or unexpected costs—ensuring ongoing relevance and agility.

Corporate budgeting is a dynamic process that involves coordination among various departments, adaptability to changing conditions, and a clear focus on the company's strategic direction. It plays a crucial role in financial planning, resource allocation, and decision-making within the organization.

Benefits of Corporate Budgeting:

1. Goal Alignment:

Corporate budgeting aligns the entire organization towards common goals and objectives. It ensures that resources are allocated in a manner that supports the company's strategic vision and mission.

2. Resource Optimization:

It facilitates the effective allocation of resources, such as capital, labor, and materials, maximizing efficiency and reducing waste. This optimization leads to better operational performance and cost management.

3. Performance Evaluation:

Budgets serve as a benchmark for evaluating the performance of different departments and the company as a whole. Variances between budgeted and actual figures help identify areas for improvement and enable corrective actions.

4. Decision Support:

Budgets provide crucial information for decision-making. They guide investment decisions, expansion strategies, and resource allocations by offering a clear financial framework to evaluate options.

5. Stakeholder Confidence:

Transparent budgeting practices foster trust among stakeholders, including investors, employees, and customers. It demonstrates responsible financial management, enhancing the organization's reputation and credibility.

Approaching the budgeting process with intention, understanding, and adaptability creates a framework for success, be it in personal financial management or within the corporate environment. It encourages responsible financial habits, fosters better decision-making and supports the realization of financial goals and organizational objectives.

What is Budget Forecasting and Planning?

Budget forecasting and planning are essential processes in corporate financial management. Budget forecasting involves predicting future revenues, expenses, and financial outcomes based on historical data, market trends, and economic conditions. It helps organizations anticipate cash flow needs, allocate resources, and set realistic financial goals.

Budget planning, on the other hand, focuses on developing a comprehensive financial roadmap for achieving those goals. It ensures that all departments align their spending with the organization's strategic priorities. Together, these processes enable businesses to manage resources effectively, mitigate risks, and adapt to changing market conditions.

For example, a company might use budget forecasting to predict sales for the upcoming quarter and then plan its marketing and operational expenditures accordingly. This proactive approach allows businesses to remain agile, ensuring long-term financial stability and growth.

Budgeting Tools for Corporate

Effective budgeting in the corporate world requires robust tools that streamline processes and provide actionable insights. Here are some popular budgeting tools used by businesses:

- ERP Systems (Enterprise Resource Planning): Integrates budgeting with other financial functions, providing a unified view of company finances. Examples include SAP, Oracle, and Microsoft Dynamics.

- Financial Planning Software: Tools like Adaptive Insights and Planful allow organizations to create detailed forecasts, scenario analyses, and dynamic budgets.

- Spreadsheets: While basic, tools like Microsoft Excel and Google Sheets remain widely used for small businesses due to their flexibility and customization options.

- Cloud-Based Budgeting Tools: Platforms like QuickBooks Online and Xero simplify budgeting for teams with real-time collaboration and secure access from anywhere.

- AI-Driven Tools: AI-powered solutions, such as Anaplan, enable advanced analytics and predictive modeling, helping businesses make data-driven decisions.

Investing in the right budgeting tools empowers businesses to optimize resource allocation, improve financial visibility, and achieve strategic goals efficiently. These tools are particularly vital for maintaining agility in today’s fast-paced corporate environment.

FAQs

What are the three main types of budget?

Operating Budget, Capital Budget, Cash Flow Budget.

What are the three P's of budgeting?

Planning, Prioritizing, Performance.

What are the three M's of budgeting?

Measure, Monitor, Manage.

What is a budget line?

A budget line is a graphical representation of all possible combinations of two goods that can be purchased with a given budget, illustrating the trade-offs.

What is budget management?

Budget management is the process of overseeing and controlling the allocation and expenditure of funds to ensure financial stability and goal achievement.

What is performance budgeting?

Performance budgeting is a budgeting approach that links the allocation of funds to specific outcomes or performance metrics, aiming to improve efficiency and effectiveness.

What is a sales budget?

A sales budget is an estimate of expected sales revenue over a specific period, often used to plan production, inventory, and marketing strategies.

What are the five stages of the budgeting process?

Preparation, Approval, Implementation, Monitoring, Evaluation.

What is a budget example?

A budget example is a household budget that includes categories like rent, utilities, groceries, and savings, with allocated amounts for each based on income and expenses.

.avif)