Budget 2024: Understanding the income tax slab changes

The recent Budget 2024 has brought significant changes to the income tax slab structure, capturing the attention of taxpayers across India. The new income tax slab revisions have an impact on how individuals calculate their tax liabilities and make financial decisions.

This article delves into the key aspects of the income tax slab changes introduced in Budget 2024. It explores the new tax regime, breaking down the revised slabs and rates. Additionally, it examines alterations to deductions and exemptions, helping readers understand how these updates might affect their overall tax obligations. By the end, readers will have a clearer picture of the income tax landscape for the coming financial year.

Overview of income tax changes in budget 2024

Key changes announced

Budget 2024 has introduced significant modifications to the income tax structure, focusing primarily on the new tax regime. The government has increased the standard deduction for salaried individuals to Rs. 75,000 from Rs. 50,000 under the new regime. Additionally, the family pension deduction has been raised to Rs. 25,000 from Rs. 15,000 for those filing taxes under the new regime.

One of the most notable changes has an impact on capital gains taxation. The budget has increased the exemption limit for long-term capital gains (LTCG) from listed securities to Rs. 1.25 lakhs from Rs. 1 lakh. However, the LTCG tax rate has increased from 10% to 12.5%. For short-term capital gains (STCG) from equities and equity-oriented mutual funds, the tax rate has risen from 15% to 20%.

peopleHum Payroll Software Compliance:

At peopleHum, our payroll system is now fully compliant with these updates. We have adjusted our software to reflect the increased standard deduction and revised family pension deduction, ensuring seamless payroll processing for your organization.

Comparison with previous year

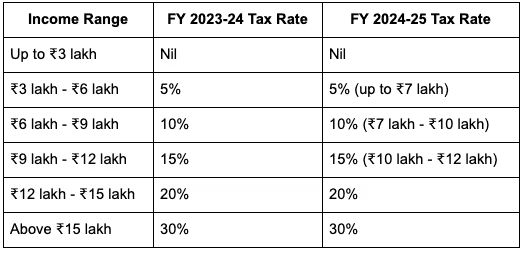

The new tax regime has undergone substantial revisions compared to the previous year. The tax slabs have been adjusted to provide more relief to taxpayers. Here's a comparison of the tax slabs for FY 2023-24 and FY 2024-25:

peopleHum Payroll Software Compliance:

We have integrated these new tax slabs into our payroll software, allowing for accurate and up-to-date tax calculations for all employees, ensuring compliance with the latest tax regulations.

Impact on different income groups

The revised tax structure has varying effects on different income groups. Lower and middle-income taxpayers are likely to see a reduction in their tax liability. The increased standard deduction and family pension deduction will provide additional tax benefits to these groups.

For taxpayers with income up to Rs. 7.5 lakhs, the new regime offers significant advantages. They can now benefit from zero tax liability if they opt for the new tax regime. This change has the potential to increase the adoption of the new regime among taxpayers.

However, the impact may be less significant for higher-income groups. The budget proposals under the new tax regime may not have a substantial effect on individuals with incomes above Rs. 20-22 lakhs.

Overall, these changes aim to simplify the tax system and provide relief to various income groups, with a particular focus on making the new tax regime more attractive to taxpayers.

peopleHum Payroll Software Compliance:

With peopleHum, your organization can ensure that all employee payrolls are processed accurately in line with the new tax regime, providing clarity and compliance across different income groups.

New tax slabs and rates under the new regime

The Budget 2024 has introduced significant changes to the income tax structure, focusing primarily on the new tax regime. These modifications aim to simplify the tax system and provide relief to various income groups. The new tax regime has become the default option for taxpayers unless they specifically opt for the old regime.

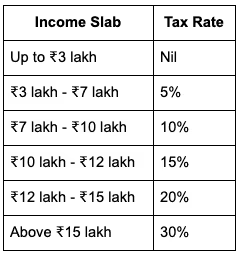

Detailed breakdown of new slabs

The revised tax structure under the new regime has undergone substantial changes compared to the previous year. Here's a breakdown of the new tax slabs for FY 2024-25:

Tax rates for each slab

Under the new regime, the tax rates have been adjusted to provide more relief to taxpayers. The first ₹3 lakh of income remains tax-free. The next slab, from ₹3 lakh to ₹7 lakh, has a tax rate of 5%. This has an impact on lower and middle-income taxpayers, potentially reducing their tax liability.

For income between ₹7 lakh and ₹10 lakh, a 10% tax rate applies. The subsequent slabs have progressively higher rates: 15% for income between ₹10 lakh and ₹12 lakh, 20% for income between ₹12 lakh and ₹15 lakh, and 30% for income above ₹15 lakh.

peopleHum Payroll Software Compliance: Our payroll software has been updated to incorporate these new tax slabs, ensuring precise and compliant tax calculations for all employees under the new regime.

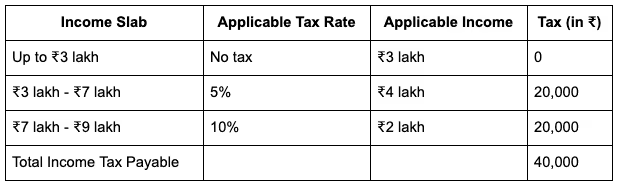

Examples of tax calculation

To illustrate how the new tax regime works, let's consider an example:

Suppose an individual has a taxable income of ₹9 lakh. Their tax will be calculated as follows:

It's important to note that under the new regime, various deductions and exemptions are not allowed. These include house rent allowance, leave travel concession, and deductions under Chapter VIA (like Section 80C, 80D, etc.). However, the standard deduction has been increased to ₹75,000, and the family pension deduction has been raised to ₹25,000 from ₹15,000.

peopleHum Payroll Software Compliance:

Our payroll system ensures that such calculations are automated and accurate, reflecting all updates in the tax regime to provide error-free payroll processing for your employees.

Changes in deductions and exemptions

Increase in standard deduction

The Budget 2024 has introduced significant changes to deductions and exemptions, particularly for those opting for the new tax regime. One of the most notable modifications has an impact on the standard deduction for salaried employees. The standard deduction limit has been increased from Rs 50,000 to Rs 75,000 under the new tax regime. This change aims to provide substantial savings for salaried employees, who can now save up to Rs 17,500 in income tax annually.

For taxpayers in the highest tax bracket, defined as individuals with a taxable income of Rs 15 lakh or higher, the increased standard deduction limit will result in a savings of Rs 7,500. Additionally, the rationalization of tax rates will lead to an extra savings of Rs 10,000, bringing the total savings for this group to Rs 17,500.

peopleHum Payroll Software Compliance:

Our payroll software reflects this increase in the standard deduction, ensuring that your employees benefit from the latest tax savings.

Changes to other deductions

Apart from the standard deduction, several other changes have been made to deductions and exemptions. The deduction on family pension for pensioners has been enhanced from Rs 15,000 to Rs 25,000 under the new regime. This change has the potential to benefit a significant number of pensioners.

Furthermore, the benefit for social securities of salaried people can accrue as a deduction of expenditure by employers towards the New Pension Scheme (NPS). The proposed increase is from 10% to 14% of the employee's salary.

Another notable change has an impact on long-term capital gains (LTCG). The exemption limit for LTCG has been extended from Rs 1 lakh to Rs 1.25 lakhs, which has the potential to provide relief to investors.

peopleHum Payroll Software Compliance:

Our payroll system has been updated to include these changes, ensuring compliance with the increased deductions and exemptions for both employees and pensioners.

Impact on taxpayers

These changes in deductions and exemptions have varying effects on different groups of taxpayers. For individuals earning up to Rs 10 lakhs annually, the potential saving is Rs 10,000 before cess is applied, with the total benefit expected to increase once cess is factored in.

All taxpayers earning over Rs 12 lakh will benefit from a tax savings of Rs 10,000 due to rate rationalization. However, savings from the standard deduction increase will vary based on income groups, with higher tax bracket taxpayers experiencing lower savings compared to those in lower brackets.

It's important to note that these changes primarily apply to the new tax regime. The old tax regime continues to offer several deductions and exemptions, including house rent and leave travel allowances, as well as deductions under Sections 80C, 80D, 80CCD(1b), and 80CCD(2). These exemptions and deductions are not available in the new tax regime, which features lower tax rates but fewer deductions and exemptions.

Conclusion

The changes in income tax slabs introduced in Budget 2024 have a significant impact on taxpayers across various income groups. The new tax regime offers simplified calculations and increased deductions, making it more attractive for many individuals. These adjustments aim to provide relief to lower and middle-income earners while streamlining the overall tax structure.

Looking ahead, these tax reforms have the potential to shape financial planning and decision-making for many Indians. The increased standard deduction and family pension deduction, along with the revised tax slabs, give taxpayers more options to consider. As individuals adapt to these changes, it's crucial to carefully evaluate personal financial situations to make the most of the new tax landscape.

At peopleHum, we are committed to staying ahead of these changes and ensuring that our payroll software is always up-to-date and compliant with the latest regulations. Our team works tirelessly to improve and upgrade our system, providing you with the most accurate and efficient payroll solutions.

Experience the benefits of our fully compliant payroll system and see how it can simplify your payroll processing.

TRY FOR FREE

FAQs

- Have there been any updates to the income tax slabs for the financial year 2024-25?

Yes, the financial year 2024-25 sees modifications in the income tax slabs, including an increase in the standard deduction from Rs 50,000 to Rs 75,000. The tax slab for the 5% rate has also been adjusted from Rs 5 lakh to Rs 7 lakh.

2. What are the revised income tax slabs according to the Union Budget 2024?

As per the Union Budget 2024, announced by Finance Minister Nirmala Sitharaman, the new tax slabs are as follows: No tax for income up to Rs 3 lakh, a 5% tax rate for income between Rs 3 lakh and Rs 7 lakh, and a 10% tax rate for income between Rs 7 lakh and Rs 10 lakh.

3. Is there an increase in the Section 80C deduction limit for the year 2024?

No, there has been no change in the Section 80C deduction limit for the year 2024. The maximum deduction available under Section 80C remains unchanged and is applicable only under the old tax regime.

4. What deductions are available in the new tax regime for the assessment year 2024-25?

In the new tax regime for the assessment year 2024-25, the standard deduction for salaried employees has been raised from Rs 50,000 to Rs 75,000. Additionally, the deduction for family pension has been increased from Rs 15,000 to Rs 25,000.

.png)